Did you know ?

Multiples charts provide an effective way to quickly analyze a company's valuation over a period of time, and compare it against the valuation of another company, a personal list, or a market index.

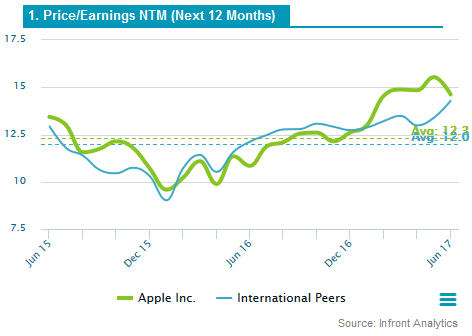

The most common multiple used in the valuation of stocks is the P/Earnings NTM multiple (Price to Earnings). P/E relates the current share price with the market expectations in terms of Earnings Per Share. This multiple is used to compare a company's market value with its earnings. A company with a high P/Earnings NTM is considered to be overvalued; a company with a low P/Earnings NTM is considered to be undervalued.

The P/Earnings NTM ratio of Thanh Cong Textile Garment Investment Trading JSC is significantly lower than the median of its peer group: around 10.00. The company valuation of Thanh Cong Textile Garment Investment Trading JSC according to these metrics is way below the market valuation of its peer group.

The P/Earnings NTM ratio of Thanh Cong Textile Garment Investment Trading JSC is significantly lower than the average of its sector (Clothing & Accessories): 11.03. The company valuation of Thanh Cong Textile Garment Investment Trading JSC according to these metrics is way below the market valuation of its sector.

The P/Earnings NTM ratio of Thanh Cong Textile Garment Investment Trading JSC is significantly lower than its historical 5-year average: 14.4. The (current) company valuation of Thanh Cong Textile Garment Investment Trading JSC is therefore way below its valuation average over the last five years.

Many methods can be used to value a company. In reality, business valuation is often a combination of these different approaches. One of the most widely used quantitative methods is the market multiples method. The market valuation is utilized generally as a primary market input, to provide an objective starting point for the valuation. Put simply, this method multiplies the sales or profits of a business by an industry averaged multiplier to calculate the Market Value of the business.

Current multiples include:

- Historical multiples based on standardized financials for the last completed fiscal period: Last, Last Twelve Months (LTM);

- Forward multiples based on consensus estimates for the current fiscal period and next ones: Next Twelve Months (NTM), FY0, FY1.

Current multiples based on per-share metrics (such as earnings per share or book value per share) are calculated using the last closing price, while current multiples based on company-level metrics (such as net sales, EBIT or EBITDA) are calculated using the current market cap or EV (Enterprise Value).