Did you know ?

Multiples charts provide an effective way to quickly analyze a company's valuation over a period of time, and compare it against the valuation of another company, a personal list, or a market index.

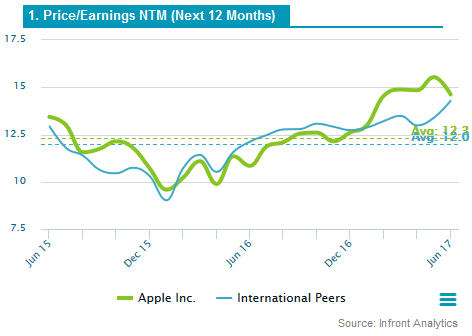

The most common multiple used in the valuation of stocks is the P/Earnings NTM multiple (Price to Earnings). P/E relates the current share price with the market expectations in terms of Earnings Per Share. This multiple is used to compare a company's market value with its earnings. A company with a high P/Earnings NTM is considered to be overvalued; a company with a low P/Earnings NTM is considered to be undervalued.

The P/Earnings NTM ratio of APA Group is significantly higher than the median of its peer group: around 15.00. The company valuation of APA Group according to these metrics is way above the market valuation of its peer group.

The P/Earnings NTM ratio of APA Group is significantly higher than the average of its sector (Pipelines): 15.85. The company valuation of APA Group according to these metrics is way above the market valuation of its sector.

The P/Earnings NTM ratio of APA Group is higher than its historical 5-year average: 35.2. The (current) company valuation of APA Group is therefore above its valuation average over the last five years.

Many methods can be used to value a company. In reality, business valuation is often a combination of these different approaches. One of the most widely used quantitative methods is the market multiples method. The market valuation is utilized generally as a primary market input, to provide an objective starting point for the valuation. Put simply, this method multiplies the sales or profits of a business by an industry averaged multiplier to calculate the Market Value of the business.

Current multiples include:

- Historical multiples based on standardized financials for the last completed fiscal period: Last, Last Twelve Months (LTM);

- Forward multiples based on consensus estimates for the current fiscal period and next ones: Next Twelve Months (NTM), FY0, FY1.

Current multiples based on per-share metrics (such as earnings per share or book value per share) are calculated using the last closing price, while current multiples based on company-level metrics (such as net sales, EBIT or EBITDA) are calculated using the current market cap or EV (Enterprise Value).