Did you know ?

Banks, insurance and financial investment firms have specific ratios, which are different from those traditionally used to analyze industrial companies.

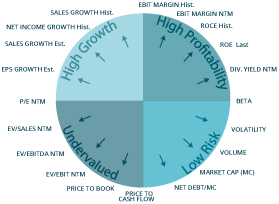

In particular, EV is not a suitable metric for financial institutions because interest is a critical component of both revenue and expenses. Likewise, EBIT or EBITDA are not calculated because separating operating and financing activities is impossible as interest, investment and debt are related to the company's core operations.

Belgium

Belgium Factsheet

Factsheet